Tax options overview

In this blog article I want to explain about the recent enhancements we have done to the tax system and what it means to different geographical regions.

But before I start it is important to understand that tax is only of interest to you if you use your own payment processing. If you use FlickRocket for payment processing, FlickRocket is the seller and FlickRocket also handles all tax obligations.

When talking about taxes, it is always important in which region you are located so the correct tax laws can be applied. FlickRocket will always present you only with the relevant settings for your region, and so you will not be able to see all options I describe below. Feel free to jump right to your region below to read on.

United States (Sales Tax)

For details on sales tax see the Wikipedia article at https://en.wikipedia.org/wiki/Sales_taxes_in_the_United_States.

In short, while it is relatively simple for digital goods (and a specific sales tax management is not required), managing sales tax for physical goods is a complex process. So if you are planning to sell physical products, read on below.

For an overview, tax rates differ based on the sellers organization, location, his “nexus” locations (e.g. a subsidiary), customer location (down to the number/street level) and the item(s) being sold. As always with taxes, there are of course many special rules and exceptions.

So, how can FlickRocket manage this for you? The answer is that we have integrated with TaxCloud. TaxCloud is an easy-to-use sales tax management service for retailers. It handles every aspect of sales tax, from collection to filing-and it’s completely free. TaxCloud makes money by receiving a very small commission from a state when sales tax funds from a remote retailer are transferred to a state.

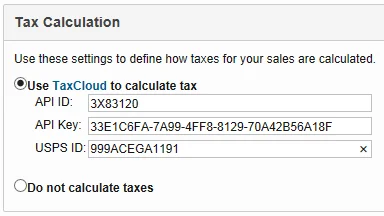

To use TaxCloud within FlickRocket you first need to create an account with TaxCloud and the US Postal Service (for address verification). Once you are done, you can activate TaxCloud and need to enter your account data. This is done on the Shop -> Settings -> General Settings page.

If you use TaxCloud, you can set a TIC (Tax Identification Code) for the following:

- Per license (e.g. there are different TICs for rentals and permanent licenses)

- Per product (project)

- Per shipping model

- Per subscription

FlickRocket has pre-associated TICs for everything. However, there may be special cases where you want to change it.

For each sale, these TICs are used and the correct sales tax is applied. And of course also sales to customers outside the US are treated correctly.

Now that your FlickRocket shop calculates and collects sales tax for you, learn how you can file your tax returns. First of all, this is completely optional – if you prefer, you can use TaxCloud only for tracking and file your sales tax return whatever way you like. However, you can also use TaxCloud to file your sales tax returns (and register your business) in many states.

European Union (VAT)

For details on the European VAT system see https://en.wikipedia.org/wiki/European_Union_value_added_tax.

In short, there is a difference between B2C and B2B sales and tax handling, tax rates and reporting obligations vary based on the seller’s country and customer’s country. There is typically no difference between digital and physical goods and FlickRocket handles the complete tax calculation and collection.

As a company in the EU you only have to think about the following options:

Business to Consumer (B2C) or Business to business (B2B)

The default selected option is Business to Consumer (B2C) which means that your primary audience is consumers. In this case FlickRocket displays the gross pricing and applies VAT (or not) based on the customer’s country.

If your target audience is primarily businesses, you have to select the B2B option under Shop -> Settings-> Payment Settings. This means the prices you define are treated as net prices and the shop displays them as such. VAT is applied (or not) based on the customer’s country and VAT-ID (which is automatically verified with the customer’s local tax authorities). Before you can select B2B, you need to enter your VAT-ID in your company settings.

Special tax rates

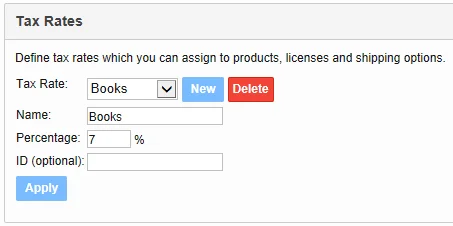

All countries have special tax rates by company or for specific goods - typical examples are for food or books (or sometimes also shipping). If you sell items like that, you need to define this specific tax before you can apply it to your sales items. This is done under Shop -> Settings -> General Settings.

Once you have defined your special tax rate, you can apply it to your licenses (for digital goods), products (projects), shipping models and subscriptions.

Countries other than the United States and the European Union (GST and VAT)

Most countries employ some form of VAT or GST tax and FlickRocket is aware of most countries default tax rate and uses it to calculate and collect taxes (if applicable). However, you need to check to see the default tax rate for your country which you can find under Shop -> Settings -> General Settings.

Most countries have special tax rates or exempts either by company or for specific items such as digital goods, food or books. So, if the default tax rate is not correct or does not apply to the goods you sell, you can define the correct tax rates to use here.

Once you have defined your special (or general) tax rate, you can apply it to your licenses (for digital goods), products (projects), shipping models and subscriptions.

Important final note

It cannot be said often enough: Taxes are important and complex. Any error can result in serious consequences. So, if you are starting a new business, you are just moving to online sales, of you are simply not certain how to treat your tax obligations, you need to make sure to get your tax setup right. Often this means to consult with a tax advisor. And trust me - this is well invested time and money.